please help me to translate this paragraghsFreeman and Tse argued unexpected profits-returns would be better explained by an S-shaped arctan relationship which is convex for bad-news frims and concave for good-news firms.Figure 9.4 provides an illust

来源:学生作业帮助网 编辑:作业帮 时间:2024/11/25 02:44:27

please help me to translate this paragraghsFreeman and Tse argued unexpected profits-returns would be better explained by an S-shaped arctan relationship which is convex for bad-news frims and concave for good-news firms.Figure 9.4 provides an illust

please help me to translate this paragraghs

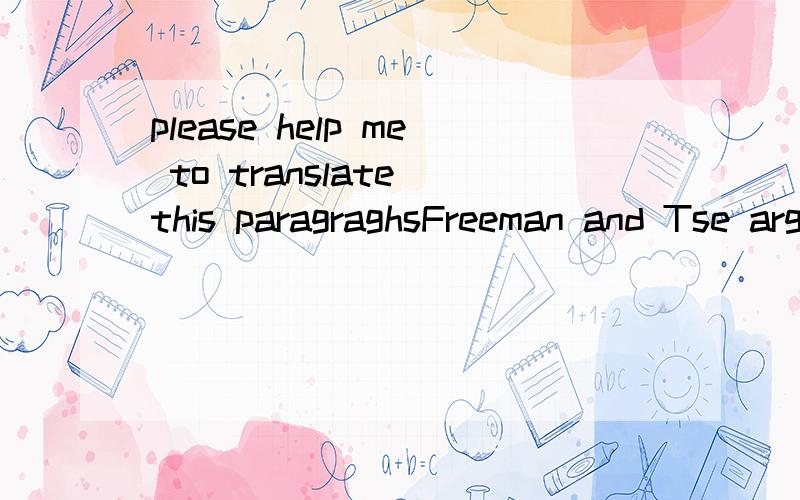

Freeman and Tse argued unexpected profits-returns would be better explained by an S-shaped arctan relationship which is convex for bad-news frims and concave for good-news firms.Figure 9.4 provides an illustration of some hypothesised non-linear relationships.Measuring unexpected earnings (profits )as deviations from median quarterly analyst forecasts,Freeman and Tse found that the application of the non-linear arctan model resulted in increased ERCs and greater predictive power in the fprm of higher adjusted simple linear models may have misspecified the profits-returns relationship.

please help me to translate this paragraghsFreeman and Tse argued unexpected profits-returns would be better explained by an S-shaped arctan relationship which is convex for bad-news frims and concave for good-news firms.Figure 9.4 provides an illust

increased ERCs and greater predictive power in the fprm of higher adjusted simple linear models may have misspecified the profits-returns relationship.