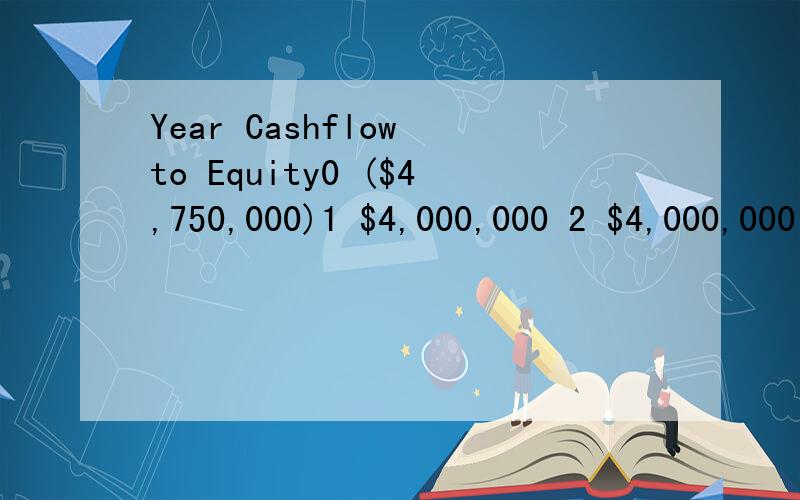

Year Cashflow to Equity0 ($4,750,000)1 $4,000,000 2 $4,000,000 3 ($3,000,000)If the cost of equity is 16%,would you accept this project?Please explain your answer.

来源:学生作业帮助网 编辑:作业帮 时间:2024/07/15 00:30:09

x��)��LM,RpN,�H��/W(�Wp-,�,�4P�P1�175�100�4T�r�

V0B���x��i

%�

���%

�i

�`�2�

�Tu��KsR*�K��S

J�J�2E�Y��%�9��ũ

�9��y eE

�y��Ez6IE��� �Cu,X��`#

T���(��X?>_���

��vF1�ٌ�/������c³9k���t�F���-O�.x>�j��9+^��dǪ[�<����Ɏ�����|�v�)۞�����`��kbn���`b`��a�gh��3R�U0Fp�A:�L�

l

��

Year Cashflow to Equity0 ($4,750,000)1 $4,000,000 2 $4,000,000 3 ($3,000,000)If the cost of equity is 16%,would you accept this project?Please explain your answer.

Year Cashflow to Equity

0 ($4,750,000)

1 $4,000,000

2 $4,000,000

3 ($3,000,000)

If the cost of equity is 16%,would you accept this project?

Please explain your answer.

Year Cashflow to Equity0 ($4,750,000)1 $4,000,000 2 $4,000,000 3 ($3,000,000)If the cost of equity is 16%,would you accept this project?Please explain your answer.

Cost of equity是融资成本 也就是说你的project在这个贴现率下要有正收益

NPV = -475 + 400/(1.16) + 400/(1.16)^2 - 300/(1.16)^3 = -25.1 < 0

净现值小于零 不take这个project

Year Cashflow to Equity0 ($4,750,000)1 $4,000,000 2 $4,000,000 3 ($3,000,000)If the cost of equity is 16%,would you accept this project?Please explain your answer.

count equ .

ARRAY1 EQU

from year to year

RS EQU 0 E EQU 1 RW EQU 2

英语翻译treasury cashflowfree cashflow 的booking数

问一个很简单滴汇编.unable to open input data segmentT0 EQU 200HT1 EQU 201HT2 EQU 202HCTLT EQU 203Hdata endsCODE SEGMENTASSUME CS:CODE,ds:dataSTART:mov ax,datamov ds,axMOV DX,CTLTMOV AL 00100111OUT DX,ALMOV DX,T0MOV AL,50OUT DX,ALmov dx,CTLTM

汇编中len1 equ

year and year与year after year与year to year与year by year的区别

year to date

FOR MANY YEAR TO

the year to

汇编中cons EQU 8000 还count equ $-buf2

汇编里面的EQU是什么意思?

year to last month,year to day ,quarter to

HAPPY NEW YEAR TO EVERY

how to write year book?

Year to the Day 歌词